Story by Ratliff CPA Editor

January 18, 2018

By now we have all heard about the new tax laws for 2018 that passed last December. There will be some changes coming up.

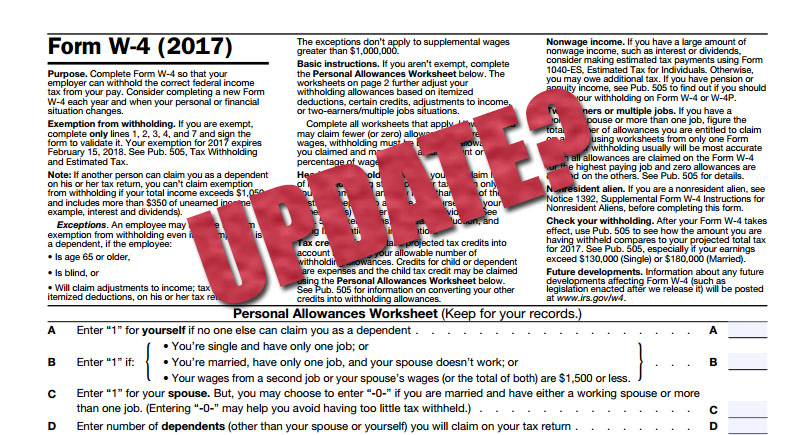

Losing the deductions for dependents and doubling the standard deduction means that all of your employees may need to fill out a new W4 as those dependent deductions are no longer valid. The issue is that the IRS has not released the new W4 form. Some sites say we can expect it in February and others say not until 2019. The IRS has kept fairly quiet about this issue, so for now this is all speculation.

An individual could claim a personal exemption of $4,050 for themselves, their spouse, and any dependents. A family of four will see their income go up by $4,050, so many families may not see a benefit of this tax law in their paychecks.

Any individual who has extra exemptions will need to file a new W4 once the IRS releases the new form.

More information on withholding tax tables can be found on the IRS website here.

Accounting for Businesses

Are you running your business at peak performance? Call on us to increase efficiency, stay in compliance, and boost revenue and profits. & Individuals.

Accounting for Individuals

Protecting your personal assets has never been more important. Our accounting services safeguard you and your family and optimize all your hard-earned dollars.

Tax Services

Don't pay more in taxes than you have to! Take full advantage of all deductions and credits with our tax planning, compliance, and preparation services.

Quickbooks

Here's a reason QuickBooks is the number one business accounting software. Put this robust software to work for you with QuickBooks setup and training.

Citizens Overseas

Helping you understand what taxes and forms you are required to file.